Surrogacy Escrow Management Lawsuits

Call Our Texas Trial Lawyers Now

Did you entrust tens of thousands of dollars to Surrogacy Escrow Account Management or SEAM to manage your surrogacy-related escrow account? Were you shocked to find that your money was gone when you tried to access it right when you needed it the most? You are not alone. SEAM, SEAM owner Dominique Side, and SEAM business partner Anthony Hall have been accused of stealing escrow funds from families around the world.

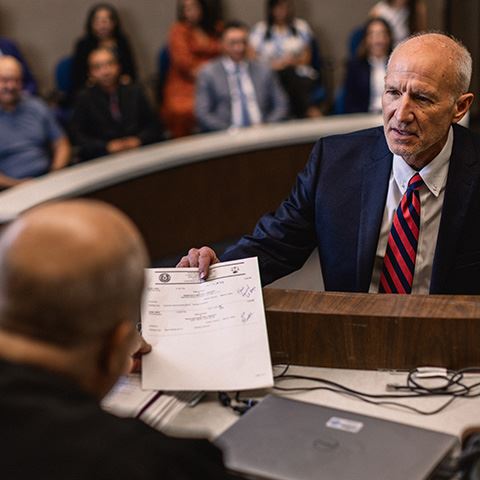

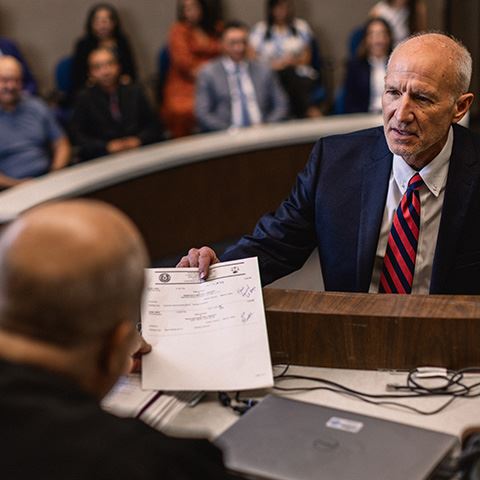

Hilliard Law has been standing up for the injured and the wronged for nearly 40 years, guided by our honor, tenacity, and keen legal knowledge. If SEAM stole or lost your escrow funds, let us know immediately. We are currently putting our decades of collective legal experience and vast resources to good use to investigate this situation and help people demand justice and compensation. We are already representing families who want to hold SEAM and Side accountable, so please don’t wait to get your case moving, too.

Talk to our Texas trial attorneys now about potential legal action against SEAM and Side. Call (866) 927-3420 and ask for a free consultation.

What is SEAM?

Surrogacy Escrow Account Management is an escrow account management firm that primarily handled escrow accounts used to facilitate payments between families and women acting as surrogate mothers for those families. In June 2024, without warning, expectant parents using SEAM’s services were notified that their money was lost and that the surrogates that they were paying to carry their children would not be paid through SEAM, meaning payments would have to be made another way. Not long after, the first lawsuit against SEAM began and a judge granted an injunction that froze SEAM’s accounts pending a forensic analysis of its bank records.

How Did SEAM Allegedly Misuse Escrow Funds?

Initial evidence in the ongoing investigations against Surrogacy Escrow Account Management, Side, and Hall suggest that millions of dollars were intentionally misused and diverted.

Records show that SEAM may have misappropriated escrow funds to:

- Launch Side’s music career as “Dom,” which included at least $2.2 million in expenses

- Launch designer clothing company “Nikki Green, LLC”

- Pay off nearly $5 million on a company credit card

- Purchase a five-acre property in Houston for Helen Yancy (also named a defendant)

How Many People Were Affected by SEAM’s Alleged Fraud?

The forensic analysis of SEAM’s bank records initiated by the judge’s injunction determined that SEAM’s escrow accounts did not have enough money to pay back the multiple families that were part of the initial lawsuit. Together, the group of 23 families are believed to have lost more than $1,000,000. However, the extent of SEAM’s alleged escrow fraud appears to be much larger.

According to a private Facebook group, more than 800 families used escrow services through Surrogacy Escrow Account Management. SEAM might have defrauded those hundreds of families around $16,000,000 in total, but further investigation is necessary.

Can You File a Lawsuit Against SEAM? Find Out Today

If you have any escrow funds managed by SEAM, you should:

- Check your account to see if the funds have been lost, if possible.

- Report the suspected fraud to your state’s auditor’s office or the FBI.

- Contact Hilliard Law if you have questions about filing a lawsuit for escrow fraud in Texas.

Our SEAM lawsuit attorneys are here to help you determine if you have the grounds to start legal action against SEAM, which might take the form of an individual lawsuit or multi-district litigation (MDL) like a class action lawsuit. In either situation, we want to be the attorneys you trust to help you down the complicated road ahead. If you used SEAM’s escrow management services to facilitate payments to a surrogate parent, then it is very likely that your funds have been misused and that you can take legal action with our help.

Get more information about SEAM escrow fraud lawsuits by calling (866) 927-3420 today.

Real Results ReaL Justice

-

$50Class Action

Million Settlement*Mr. Hilliard was the lead class counsel in Haese v. H&R Block, a class action lawsuit involving every Texan who received a rapid refund from H&R Block (approx. 300,000 plaintiffs). He assisted other class counsel in forcing H&R Block to disclose it received kickbacks for arranging loans between its tax preparation clients and predatory lenders.

-

$20Property Damage

Million SettlementOn the eve of the arbitration hearing, Hilliard Law attorneys obtained a $20 Million settlement on behalf of Nueces County, Texas for property damage that occurred as a result of Hurricane Harvey.

-

$13.5Predatory Lending

Million VerdictIn 2005, Mr. Hilliard represented multiple plaintiffs in litigation with Ocwen Loan Services, LLC (formerly Ocwen Federal Savings Bank) on allegations of predatory lending. Mr. Hilliard tried two cases which resulted in combined verdicts of $13.5 million.

It’s our mission to hold the powerful accountable for their wrongdoing. Reach out to our team immediately regarding your case to schedule a free attorney consultation today.